The current ratio shows a company’s ability to meet its short-term obligations. The ratio is calculated by dividing current assets by current liabilities. An asset is considered current if it can be converted into cash within a year or less, while current liabilities are obligations expected to be paid within one year. A current ratio of 1.5 would indicate that the company has $1.50 of current assets for every $1 of current liabilities. For example, suppose a company’s current assets consist of $50,000 in cash plus $100,000 in accounts receivable. Its current liabilities, meanwhile, consist of $100,000 in accounts payable.

The five major types of current assets are:

The denominator in the Current Ratio formula, current liabilities, includes all the company’s short-term obligations, i.e., those due within one year. It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future. Current assets, which constitute the numerator in the Current Ratio formula, encompass assets that are either in cash or will be converted into cash within a year. These typically include cash on hand, accounts receivable, and inventory.

Create a Free Account and Ask Any Financial Question

An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio. For example, in one industry, it may be more typical to extend credit to clients for 90 days or longer, while in another industry, short-term collections are more critical. Ironically, the industry that extends more credit actually may have a superficially stronger current ratio because its current assets would be higher. For example, a normal cycle for the company’s collections and payment processes may lead to a high current ratio as payments are received, but a low current ratio as those collections ebb. Calculating the current ratio at just one point in time could indicate that the company can’t cover all of its current debts, but it doesn’t necessarily mean that it won’t be able to when the payments are due.

- The current ones mean they can become cash or be paid in less than a year, respectively.

- Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital.

- A large retailer like Walmart may negotiate favorable terms with suppliers that allow it to keep inventory for longer periods and have generous payment terms or liabilities.

- Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management.

- They may borrow from suppliers (increasing accounts payable) and actually receive payment from their customers before the money is due to those suppliers.

How to Calculate the Current Ratio in Excel

This account is used to keep track of any money customers owe for products or services already delivered and invoiced for. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial biggest tax haven in u s south dakota says pandora papers investigation management and make informed business decisions. To give you an idea of sector ratios, we have picked up the US automobile sector. Average values for the ratio you can find in our industry benchmarking reference book – Current ratio.

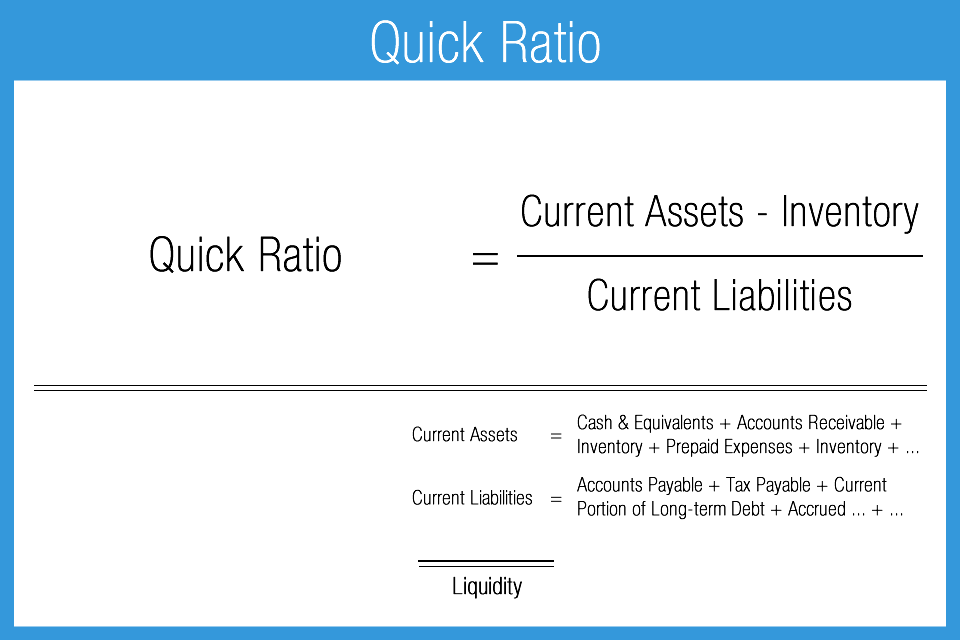

To calculate the current ratio, divide the company’s current assets by its current liabilities. Current assets are those that can be converted into cash within one year, while current liabilities are obligations expected to be paid within one year. Examples of current assets include cash, inventory, and accounts receivable. Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

How we make money

But a too-high current ratio may indicate that a company is not investing effectively, leaving too much unused cash on its balance sheet. The current cash debt coverage ratio is an advanced liquidity ratio. It measures how capable a business is of paying its current liabilities using the cash generated by its operating activities (i.e., money your business brings in from its ongoing, regular business activities). If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. Sometimes this is the result of poor collections of accounts receivable.

It represents the funds a company can access swiftly to settle short-term obligations. A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. XYZ Inc.’s current ratio is 0.68, which may indicate liquidity problems.

Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio. Seasonality is normally seen in seasonal commodity-related businesses where raw materials like sugar, wheat, etc., are required. Such purchases are done annually, depending on availability, and are consumed throughout the year.

The trend is also more stable, with all the values being relatively close together and no sudden jumps or increases from year to year. An investor or analyst looking at this trend over time would conclude that the company’s finances are likely more stable, too. In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Changes in the current ratio over time can often offer a clearer picture of a company’s finances. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills.