Contents:

Do not invest in stocks because everybody is talking about them. Which means you should only invest in stocks that you understand. On this list of motivational quotes, this quote by Jim Cramer is more intended as a statement than a quote or advice. There can be shares that are at an all-time low and are still not worth paying for.

There can be shares that have reached their all-time high and still be worth investing in. Which offers the most profitable investing ideas in India. You can have a look at the Video Reviews provided by our ongoing current clients regarding Indian-Share-Tips.Com Services to include Bank Nifty Option Tip. You must have a look to know about their satisfaction level, profit generated and complaints if any. 11) “Waste your money and you’re only out of money, but waste your time and you’ve lost a part of your life.”— Michael Leboeuf. 10) “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard.

When you know about investing or trading, you must put it to the right use. Having knowledge but not using it in the stock market is worthless. When you do not have any analytical or technical knowledge in the stock market, it is better to look for stocks that can grow and give good returns in the future. Any decision taken without prudent knowledge will lead to losses most of the time. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Losers

Going against the majority is the true way to make windfall gains in the stock market. This is one place where trying to fit in can be a giant mistake. Among the motivational quotes here, this one by Warren is probably the most famous one on this entire list.

We have found the following best trading quotes for you. Although markets may change, this trading advice is timeless. 7) “You cannot make profits in the stock market unless you have the ability to bear losses.”

trading quotes

It will show you what’s new since the last time you checked the feed, without having to visit the website. Ltd. makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes. Move over quotes like ‘there is no substitute for hard work’, and ‘buy low, sell high’. The only way to consistently make money in the market is to think independently and act Decisively.

Compounding is possible when you invest in stocks of companies and hold them for a very long time. Huge returns can be made by holding them in the long run. George Soros is a Hungarian-American billionaire investor and philanthropist who is known as “The Man Who Broke the Bank of England”. He is among the top successful investors in the world with having a Net worth of $8.3 billion . Soros early studies of philosophy formulated an application of Karl Popper’s General Theory of Reflexivity to Capital markets.

Best George Soros Quotes on Successful Investing

The legendary investor has doled out such great advice to the markets that he has several motivational quotes to his credit. When you want to make returns through investing or trading in the market, you have to be a smart investor, there is no shortcut to it. If you do not have the patience you will sell your stock and another person will buy it. That other person if holds the stock for the long term, he has good chances of making good returns. Therefore, a patient person gets his shares from an impatient person.

By coming up with alternate scenarios, you can save yourself from getting locked in one idea where the market can disappoint you. By creating different scenarios – you can able to shift to your alternate view of the market condition, which may save you from any loss. So what Warren Buffet suggests is that once your understanding of stocks is good enough, you should invest n fewer companies.

10 quotes from WallStreetBets to help explain the Reddit-trading phenonmenon – Markets Insider

10 quotes from WallStreetBets to help explain the Reddit-trading phenonmenon.

Posted: Sun, 31 Jan 2021 08:00:00 GMT [source]

This approach will give better to get companies to take action on social issues in the stock market. Most of the trades or investments fail in the market due to high expectations. When you keep high expectations in the market, you would be let down. Therefore, keeping a realistic approach in the market would help you in becoming a successful trader. This tip is a value for money for all i.e whether one can see the trading terminal or not or is dealing through a broker on phone at BSE, NSE or in F&O. Thus you are on a correct path of making money every day with single daily accurate tip.

“Know what you own, and know why you own it.” – By Peter Lynch

There is a huge difference between a good trade and good trading. In trading, everything works sometimes and nothing works always. You’re going to learn a million things, then you need to forget them all and focus on one. To doing well or small companies grow to large companies.

Here are 10 solid stock market motivational quotes that come straight from the biggest names in the investing world. The best time for investment in the stock market is when others are fearful and pessimistic about the future of the market. Whereas, the best time to sell a stock in the stock market is when others are greedy and optimist about the future of the market. The fundamental rule of the stock market is buying stocks on the basis of balance sheet and not around the positive news surrounding it. Stock bough on good fundamentals will give good returns in the long run. It is committed to provide a commodity Exchange platform for market participants to trade in a wide spectrum of commodity derivatives.

This Investing tip highlights that- the number of trades you win or lose is immaterial. You should really focus on how much money you make on the successful trades compared to how much money you lose on unsuccessful trades. The qualitative research is must when you buy or sell a particular stock in the market. Geroge Soros says that when you are wrong in trade, you are preparing yourself for longer trades in the Market. It is common among the successful traders that knowing you are wrong and it – is one of the primary steps for successful trading. Very smart people have tried to understand and predict the movement of the stock markets.

I would invest instead and let the investments cover it.” – Dave Ramsey. Get information about allocation, delivery, stock position, warehouse service providers and list of clearing banks. Get latest future and spot quotes access to advance charting tools, heatmaps and important reports. Equity AnalysisHello friends today we will see long term, short term analysis of Reliance, Torrent Power, Indusind Bank and Hdfc Bank.

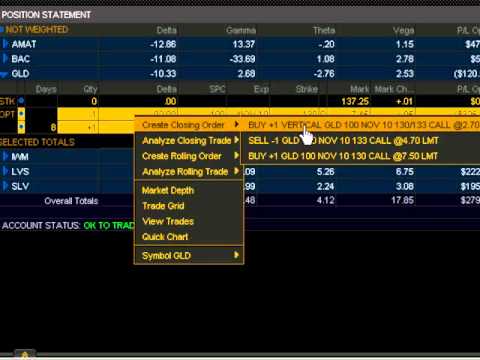

https://1investing.in/ Options TradingJoin this educational stream to learn all about option buying and writing. Ask your questions, share your ideas and help the community learn the skills necessary to succeed in Options. Join this educational stream to learn all about option buying and writing. Alexander Elder is a famous trader and the author of many international best-seller trading books which includes “The New Trading for a Living”. Whether you are already into trading or just starting out your trading journey, you will find a lot of value in his books. 8) “Buy when others sell and sell when others buy – the stock market mantra.”

- The losses can be minimised with a stop loss while the upside can be maximised by holding the stocks for the long term.

- Veteran stock market investor Rakesh Jhunjhunwala, who owned recently-launched Akasa Air airlines, passed away at the age of 62 years in Mumbai this morning.

- Before investing in a stock, find out what business the company is doing.

- Profitability, Growth, Valuation, Liquidity, and many more filters.

- Fortunately we have great traders of the past and present to guide us.

The basic rule to become successful in the stock market is to have a consistent approach and not to be stupid. If you follow these two things, you do not have to be very intelligent to become a successful investor or trader in the market. To become a successful investor or trader you must have the ability to find the true value of a company and it is available at cheaper valuations. Whenever you invest in the stock market for the long term you must ensure that you are investing in the business of the company rather than just the stock.

6) “Emotional investment is a sure way to make loss in stock markets.” The Ace stock market investor also ran a privately-owned stock trading firm called RARE Enterprises. He was always bullish about India’s stock market and whatever stocks he purchased mostly turned into a multibagger. Veteran stock market investor Rakesh Jhunjhunwala, who owned recently-launched Akasa Air airlines, passed away at the age of 62 years in Mumbai this morning. The airline began commercial operations this month with a maiden flight from the financial capital of Mumbai to the city of Ahmedabad. He had teamed up with ex-Jet Airways CEO Dube and former IndiGo head Aditya Ghosh to set up Akasa.

- Geroge Soros says that when you are wrong in trade, you are preparing yourself for longer trades in the Market.

- He believes that the stock market is meant to make money but before that, you must ensure that you do not end losing it.

- Live Options TradingJoin this educational stream to learn all about option buying and writing.

- “The stock market is a device for transferring money from the impatient to the patient.”

- Whenever you invest in the stock market for the long term you must ensure that you are investing in the business of the company rather than just the stock.

The key to Successful Trading is to cut losses Quickly and let winners Run. Information available on this website is solely for educational purpose only. The advice, suggestion and guidance provided through the blogs are based on the research and personal views of the experts. Please do your own research before making your investment decision.

There might be times when you might have to sell the stock because it does not suit your investment style. Invest in the stocks of an industry you’ve researched thoroughly and be ready to see your investment go low before touching new highs. “Bottoms in the investment world don’t end with four-year lows, they end with 10- or 15-year lows.” – By Jim Rogers.

He renders a clear picture of asset bubbles and fundamental value of the securities as well as discrepancies used for wapping stocks. There are some rules of investing and trading in the stock market. Always ensure that stocks meet those parameters and if they do not, avoid them. By entering into stocks without making sure they fulfil the respective criteria will lead to losses. In the stock market, you will learn new things every day. You must make sure that every next day in the market you come up learning new concepts and things about the stock market to be a successful trader.

Focusing on relevant things is a sign of an intelligent investor. Diversification is often required by those investors who are not much aware of what they are doing in the market. If you have the right set of knowledge and skill, diversification of the portfolio is not important in the stock market.